7 Powerful Ways Black Americans Can Build Wealth & Gain Freedom (2025)

Discover the top 7 wealth-building strategies Black Americans can use in 2025 to gain financial freedom, close the racial wealth gap, and create a legacy.

Why Black Wealth Matters in 2025

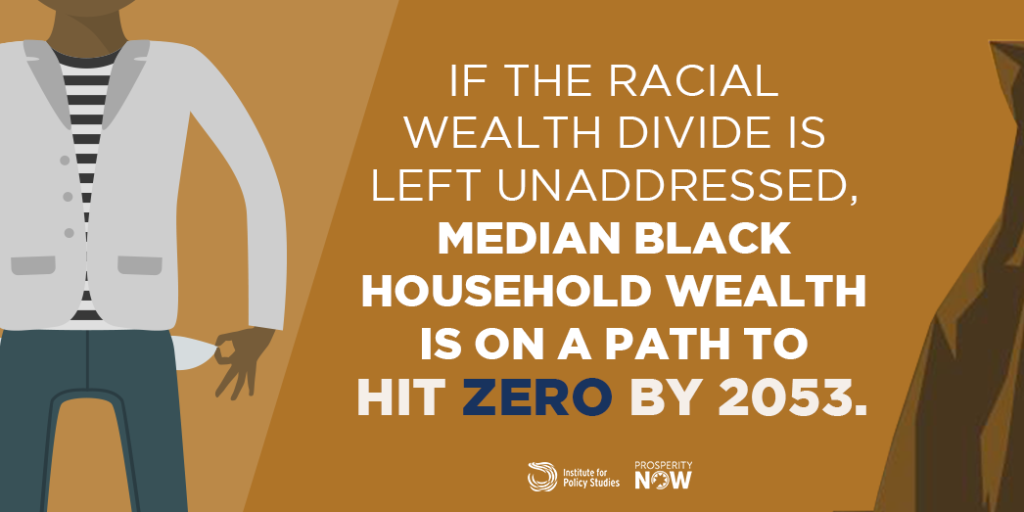

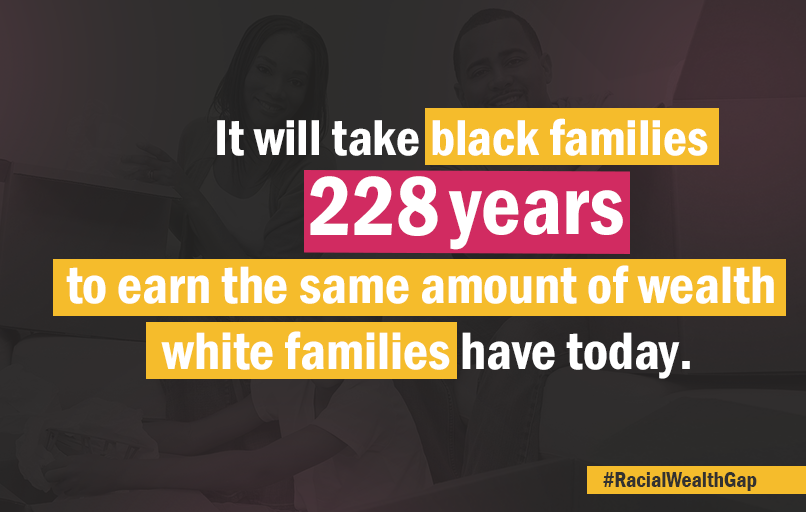

Building wealth in America is hard. For Black Americans, it’s a brutal, ongoing struggle. This fight comes from profound injustice, economic exclusion, and broken promises. Such as “40 acres and a mule.” But there is real progress. Since the pandemic, Black wealth has grown by over 60%—the most significant increase on record. The racial wealth gap persists, but momentum is shifting. Now is the time to harness that momentum. In this post, I’ll share 7 powerful strategies. These tips can help Black families build wealth, protect their assets, and regain financial freedom—starting now.

The Journey Toward Wealth: A Personal and National Awakening

Many aspire to wealth and financial freedom. Black Americans experience a multifaceted journey. It includes systemic injustice, historical betrayal, and ongoing economic exclusion. The fight for financial equity has deep roots. It spans from slavery and segregation to redlining and wage gaps. Yet, there’s reason for hope.

Recent Federal Reserve data indicate that Black household wealth has increased by over 60% since the start of the COVID-19 pandemic. The racial wealth gap remains large. Black households hold less than 15% of the wealth of white households. But the push for change is gaining strength.

This guide is here to inspire Black Americans to build wealth in 2025. These methods focus on education, collective action, and economic empowerment. They begin by understanding our financial reality.

Wealth is the ability to experience all aspects of life.” — Henry David Thoreau.

Conversations with my Grandmother.

At the time of writing this, I had a conversation with my paternal grandmother, who had turned 93 in August of 2022. I went to visit her recently. My siblings and I wanted to spend time with her and let her pour her wisdom and love into us while she was still here to do so.

We love to hear our grandmother’s stories, especially about growing up in the South. While growing up, she often shared stories of her family’s work in the fields and for white families.

She thinks it’s unfair. The same people in Congress are from her generation, the Silent Generation. Their families have generational wealth.

She often talks about her “40 acres and a mule “; she says the government of the United States of America owes her.

My Grandmother believed that God had her here for a reason. She felt her descendants would and should be as wealthy as their peers today.

Her words have prompted me to take building wealth more seriously and to learn everything I can about it.

Understanding the Racial Wealth Gap

Wealth is not just income. Its assets—property, savings, investments—minus debts. It provides a cushion in emergencies, fuels entrepreneurial dreams, and secures generational legacy.

Yet, according to McKinsey & Company:

- Black workers earn 30% less than white workers.

- 3.5 million Black U.S. households have a negative net worth.

- The average white household has about 8 times the wealth of the average Black household.

Systemic issues are the root of the problem.

- Historical Dispossession: Black Americans faced barriers to wealth building. The government denied them the promise of 40 acres and a mule. They experienced redlining and GI Bill exclusions, which locked them out of opportunities.

- Wage Discrimination: Centuries of underpaying Black laborers and excluding them from high-paying industries.

- Limited Access to Financial Tools: Black Americans face extra barriers to loans and investments. They face higher interest rates and receive fewer approvals.

Brookings says the wealth gap isn’t about education, income, or saving habits. It’s structural. But understanding this gives us the power to challenge and change it.

A Legacy Denied: The Truth Behind “40 Acres and a Mule”

Following the Civil War, General Sherman’s Field Order No. The government promised 40 acres and army mules to Black families who were enslaved. It was the first—and only—attempt at reparations for slavery. Within months, President Andrew Johnson revoked the order. The authorities returned the land to former Confederates.

If this policy had been in place, Black Americans would have gained freedom, assets, autonomy, and dignity. Instead, many were forced into sharecropping and generational poverty.

This legacy still haunts us. Generational wealth wasn’t just denied—it was systematically extracted. The vision continues today through efforts for economic justice, reparations, and Black entrepreneurship.

What Is Wealth for Black America in 2025?

Wealth isn’t about cash—it’s about options:

- The freedom to quit a toxic job

- The ability to fund your child’s education

- The power to invest in your community

- The choice to retire with dignity

Today, wealth for Black families must also include:

- Financial Literacy: Knowing how to manage, multiply, and protect your money

- Health and Wellness: Because stress, illness, and burnout derail wealth-building

- Legal Protection: Wills, trusts, insurance, and estate plans

Building wealth is holistic. It’s about systems, knowledge, discipline, and support.

7 Ways Black Americans Can Build Wealth in 2025

Here are seven foundational and empowering strategies you can begin implementing today.

1. Organize for Family LLCs

Pooling money is a time-tested strategy. Create a Family Investment LLC with 5–10 trusted relatives. Together you can:

- Buy property

- Start a business

- Invest in stocks or funds

- Provide capital to family-owned ventures

This collective model establishes a legal framework, offers tax benefits, and provides long-term investment capabilities. Utilize platforms like Vesterr to invest in commercial real estate projects led by Black entrepreneurs, or consider Small Change to join impact-driven campaigns revitalizing Black communities, often starting with a minimum investment of just $1,000.

2. Invest in Real Estate (Even with Low Capital)

Black homeownership is at a historic low. But you don’t need to go alone. Here’s how:

- Partner with a friend or sibling to sell a duplex or multifamily home as a team.

- House Hack: Live in one unit and rent out the other.

- REITs: Invest in real estate with as little as $10 using Real Estate Investment Trusts.

Every property purchased becomes a potential legacy tool. Build equity now, rent it out later.

3. Build and leverage good credit

Your credit score can unlock—or block—access to loans, housing, and jobs. Here’s how to level up:

- Use a secure credit card and make timely payments.

- Ask a relative with excellent credit to add you as an authorized user to their account.

- Dispute errors and track your score monthly.

A strong credit score means you pay less over time and gain more access to wealth.

4. Create a Knowledge Club

The wealth gap isn’t financial—it’s informational. Form a book or podcast club focused on:

- Investing and budgeting

- Entrepreneurship

- Mental health and money trauma

Recommended reads:

Meet monthly. Apply what you learn. Share resources. Learn how to build an income-generating blog or business online.

5. Get Insurance + Estate Plans

According to LegalZoom, more than 70% of Black adults don’t have a will or trust. This means that wealth is lost to probate or state seizure.

Secure your legacy by:

- Getting term or whole-life insurance

- Creating a simple will (many are free online)

- Naming beneficiaries on all accounts

No matter how small your estate, protecting it is an act of love and legacy.

6. Focus on Health and Mental Wealth

You can’t build wealth if you’re under constant stress, dealing with illness, or fighting for survival. Not possible to remove the adverb.

- Hypertension

- Diabetes

- Depression and anxiety

Invest in your health with routines that support long-term resilience:

- Use your PTO

- Walk 20 minutes daily

- Practice therapy or journaling

Wellness is wealth. Burnout is expensive.

7. Buy Black, Invest Black, Hire Black

Circulating dollars within the Black community amplify collective wealth. The NAACP says that every dollar spent at a Black-owned business stays in the community 2 to 3 times longer.

Ways to engage:

- Use platforms like WeBuyBlack, Official Black Wall Street, and Etsy for Black-owned goods

- Hire Black coaches, artists, freelancers

- Bank with Black-owned credit unions like OneUnited Bank

It’s not about exclusion—it’s about equity.

The Role of Policy: Can Politics Close the Gap?

While individual action is decisive, systemic change requires policy reform. As of 2025:

- HR 40 (the reparations study bill) is still stalled in Congress

- The Biden administration is over, and equity plans face opposition in the courts

- Republican tax policies continue to favor corporations and high-income earners

We need:

- Universal baby bonds

- Student loan forgiveness

- Housing grants for first-gen Black homebuyers

Change will require voting, advocacy, and economic organizing. It’s a dual track—personal responsibility and policy pressure.

How to Build and Protect Black Wealth in a Shifting Political Climate. (Trump, Project 2025 & Project Esther)

We cannot discuss Black wealth in 2025 without addressing the political winds reshaping America. A Trump-led administration could impact our economy, civil rights, and finances, as well as projects like Project 2025 and faith-based initiatives, such as Project Esther. Show a growing conservative influence.

Let’s break this down.

🔥 What Is Project 2025?

Project 2025 is a complete policy plan created by the Heritage Foundation, a conservative think tank. It shows how a future Republican administration might reshape the U.S. government. The focus would be on Christian nationalism. It aims to reduce federal oversight, remove diversity programs, and increase executive power.

What it means for Black Americans:

- Cuts to federal protections include:

- Civil rights

- DEI initiatives

- Housing equity

- Education access

- Cutting back or removing financial watchdogs, like the CFPB, harms consumers. These agencies shield people from predatory loans and discrimination.

- Increased deregulation benefits corporations but harms workers, renters, and low-income households.

✝️ What Is Project Esther?

Evangelical groups lead Project Esther. Its goal is to restore traditional family and religious values in government and policy. Faith is a significant aspect of many Black households. This initiative often misses or ignores people who don’t fit its narrow framework.

What it means for Black Americans:

- The rollback of women’s reproductive rights and family planning tools affects financial independence.

- A mix of church and state has often left out Black faith leaders unless they share the same political views.

- Schools are changing their curricula. They are leaving out Black history, economic injustice, and systemic inequality. This means students won’t learn about these critical topics.

🛡️ What Can We Do to Protect Ourselves and Our Wealth?

- Understand the policies.

- Don’t follow headlines. Read the plans. Know what’s coming. Ignorance is not bliss—it’s a trap.

- Diversify your assets.

- Invest in different areas. Consider real estate, digital business, insurance, and gold or silver if needed. Don’t put all your faith in one institution, especially if federal protections weaken.

- Secure legal and financial protection.

- Create a trust or will to protect your assets from probate or unfair seizure.

- Work with Black-led financial institutions or cooperatives to support your community.

- Create a trust or will to protect your assets from probate or unfair seizure.

- Grow community-based economies.

- Create local bartering systems, investment clubs, and skill-sharing networks.

- Support mutual aid and Black-owned cooperatives.

- Stay politically engaged—even when disillusioned.

- Local elections affect housing, zoning, education, and policing.

- Local decisions build national policy.

- Organize. Vote. Advocate.

- Local elections affect housing, zoning, education, and policing.

- Get ready in both spirit and mind.

- Project Esther’s rise reminds us that faith can be co-opted. Connect with spiritual communities that support justice, equity, and truth. Avoid performative religion that acts as a weapon.

🧠 Bottom line: Political instability, theocracy, and economic deregulation are not just abstract threats. They are strategies. And they can directly impact your wealth, freedom, and future.

Our power lies in preparation.

We are not victims—we are visionaries. And we must protect what we build with strategy, foresight, and unity.

“You may not control all the events that happen to you, but you can decide not to be reduced by them.” — Maya Angelou.

Action Steps: Where Do I Start?

- Calculate your net worth (assets – debts)

- Open a high-yield savings account

- Review your credit report for free at annualcreditreport.com

- Create a 3-month emergency fund

- Join or create a book club focused on wealth

- Get a will—even if it’s basic

- Sign up for financial education platforms, such as FDIC.gov.

Ready to start your online income journey? Join Wealthy Affiliate for step-by-step training.

Final Word: Wealth Is Our Birthright

We are no longer asking—we are building. Black Americans are rising from oppression. They are creating paths to freedom, ownership, and prosperity. It won’t happen overnight, but it will happen with intention.

Your legacy starts with a decision. To learn. To act. To lead.

✅ Subscribe to the blog for more guides

✅ Share this post with your community

✅ Explore the Empowered Breakthrough Activation Journal

✅ Visit my shop for tools that empower your next move

Let’s build. Let’s rise. Let’s reclaim what was ours all along.

Pin This Article

7 Ways to Build Black Wealth & Reclaim Freedom (2025 Edition)

Let’s circulate dollars, elevate our families, and build a future rooted in justice, dignity, and power. ✊🏾

This article offers a wealth of information and guidance on overcoming financial challenges, specifically tailored for Black Americans who face unique systemic barriers. I appreciate how it underscores the importance of community efforts and mindset shifts, alongside actionable strategies like real estate investment, credit building, and education. The historical context is also valuable, as it highlights how past injustices contribute to today’s wealth gap, making it clear that wealth-building is not only a personal goal but also a means of creating generational equity.

One question I have is about actionable first steps for those with limited resources or high debt levels. For individuals just starting their financial journey, what would be the most impactful initial moves? Should they focus more on credit repair, savings, or investing? Additionally, could you provide more examples of community-based initiatives that have successfully helped Black Americans build wealth and support one another? Thank you for this empowering and insightful piece!

Thank you so much for your thoughtful comment and insightful questions, Amalthe! I’m glad to hear that the article resonated with you and highlighted the importance of both individual and community-focused approaches to financial empowerment. Addressing the unique challenges Black Americans face is essential to creating lasting change, and I’m honored to be part of that conversation.

For individuals with limited resources or high debt levels, the most impactful initial steps often involve a balanced approach to credit repair, savings, and knowledge-building:

Credit Repair and Management: If debt is significant, focusing on credit repair is a powerful first step. Improving one’s credit score opens the door to better financial opportunities, like lower interest rates and more affordable housing options. Strategies like paying down high-interest debt first or consolidating debt with lower-interest options can make a big difference.Building an Emergency Fund: Creating a small, manageable emergency fund provides a sense of security and reduces reliance on credit in tough times. Even setting aside a little each month can build momentum and provide a foundation for future financial growth.Investing in Knowledge: If resources are limited, investing in financial literacy—through free workshops, online courses, or local community programs—can provide valuable knowledge on real estate, stock investment, and credit strategies. Knowledge is often the foundation for smart, long-term decisions.

In terms of community-based initiatives, programs like The Collective Blueprint and The Greenwood Project are doing incredible work. The Collective Blueprint supports Black entrepreneurs in building sustainable businesses, while The Greenwood Project focuses on financial literacy and investment skills for Black youth. These programs create networks of support and open pathways to financial growth.

Thank you again, Amalthe, for engaging so deeply with this topic. It’s a privilege to discuss such meaningful steps toward financial empowerment, and I’m here if you have any further questions!

Warmly,

Jamie