Find the best ways for Black Americans to build wealth and gain financial freedom. Learn strategies and insights from the latest data. They will empower your financial journey.

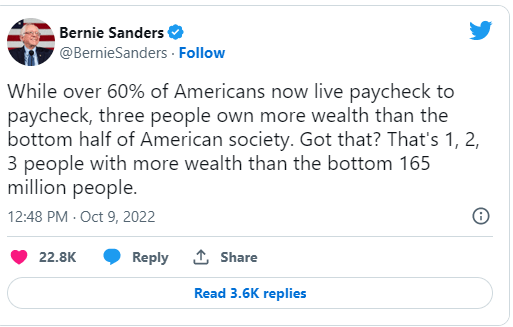

Many aspire to wealth and financial freedom, a journey that can be particularly challenging for Black Americans due to systemic barriers and historical inequities. However, recent data brings hope, showing a 60% increase in Black wealth since before the pandemic. This progress is a testament to the potential for wealth-building and a brighter future for Black Americans.

It’s the most significant increase on record. The racial wealth gap is still substantial. The median wealth of Black households lags behind that of White households.

One crucial step towards wealth building is financial literacy. Many Black Americans face an uphill battle in this area, often lacking access to financial education and resources. A McKinsey & Company report revealed that Black workers earn 30% less than their white counterparts, and 3.5 million Black households have a negative net worth due to debt. To bridge these gaps, we must focus on improving financial education, funding community resources, and advocating for economic equity policies.

Other strategies, also related to financial literacy, are vital for building wealth. They include investing in real estate, starting a business, and prioritizing health. It’s critical to have a long-term plan. It should save, invest, and protect assets with insurance and estate planning. These steps can help Black Americans build wealth and gain freedom, leading to a fairer future.

The Best Way to Get Wealthy

Strategies for How Black Americans can Begin Building Wealth

“If one is lucky, a solitary fantasy can transform one million realities.”

— MAYA ANGELOU

Many Americans are protesting nationwide. They oppose the mistreatment of Black men, women, and children.

Some march for change in the oppression of Black lives. Others, stuck at home, feel hopeless, overwhelmed, and broke.

Some Black Americans are changing how they build wealth. We seek the best ways to create wealth for our families.

Black people hold the power to change their situation. It’s a collective effort that requires a shift in thinking, education, and, most importantly, action. By standing together, maintaining consistency, and fostering unity in our families and communities, we can pave the way for a more equitable future.

Black Americans can build wealth by using these 7 methods.

Conversations with my Grandmother.

My paternal grandmother turned 93 in August of 2022. We went to visit her recently. My siblings and I wanted to spend time with her and let her pour her wisdom and love into us while she was still here to do so.

We love to hear our grandmother’s stories, especially about growing up in the South. While growing up, she often shares stories of her family’s work in the fields and for white families.

She thinks it’s unfair. The same people in Congress are from her generation, the Silent Generation. Their families have generational wealth. It is not possible to remove the adverb.

She often talks about her “40 acres and a mule “; she says the government of the United States of America owes her.

My grandmother believes that God still has her here. People think her descendants will be as wealthy as their peers today.

Her words have prompted me to take building wealth more seriously and to learn everything I can about it.

The Truth Behind ’40 Acres and a Mule.’

We’ve all heard the story about the promise of “40 Acres And A Mule” made to formerly enslaved people.

The promise represented the initial attempt to provide reparations to newly freed slaves.

Slavery in the United States deprived generations of the chance to own land.

Legally, enslaved people could not own anything, but in practice, they acquired capital.

But, they were then and still are today the lowest in the capitalist system.

As legal slavery ended. Many freed people expected to own the land they had worked for. Some abolitionists had led them to expect this.

Not possible to remove the adverb. Enforcing this policy might have made a difference.

If they had been able to build wealth and pass it on, we would see a more inclusive America. It would have wealthy, free Black people. They would uphold the American principle of equality for all.

What is Wealth?

Wealth, or a family’s net worth, opens many doors for Americans.

Wealth makes it easier for people to switch jobs, move, and handle emergencies.

It helps parents pay for their children’s education. It also lets workers save for retirement.

It is the most complete measure of a family’s future economic well-being.

Families rely on their wealth to pay their bills if they become unemployed or retire.

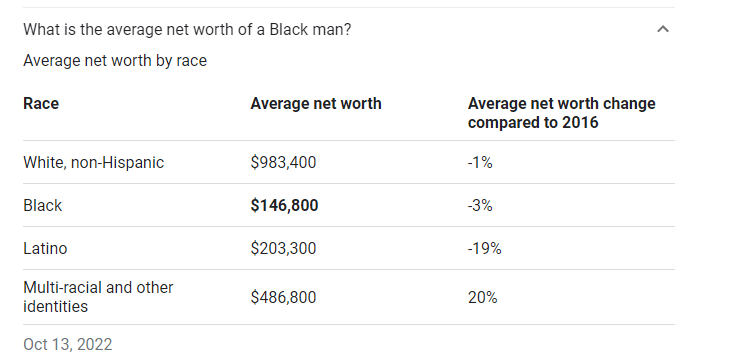

Unfortunately, wealth in this country is unequal by race. It is especially so between white and Black households.

Black American families have a fraction of the wealth of white families. It puts them in a tough spot and limits their chances to advance economically.

Black Americans have less wealth than whites. This is true even with higher education levels.

Less wealth translates into fewer opportunities for upward mobility. Lower incomes and fewer chances to build or pass down wealth hurt future generations.

Several vital factors deepen this vicious cycle of wealth inequality.

Black households, for example,

- A long history of employment discrimination has reduced Blacks’ access to tax-advantaged savings.

- Mortgage market discrimination is well-documented. It means that Black people are much less likely to be homeowners than White people. This means they have less access to the savings and tax benefits of owning a home.

- Discrimination and segregation in the labor market limit Black people. They have fewer, less profitable jobs than White people.

Also, the tax code gives high-income families more significant breaks on housing and retirement. Black Americans have lower incomes. So, they get fewer tax benefits, even if they are homeowners or have retirement accounts.

Persistent discrimination in housing and labor markets fuels wealth inequality. It worsens segregation and creates a negative cycle.

Black households, for example,

- Blacks have far less access to tax-advantaged savings due in part to a long history of employment discrimination and other discriminatory practices.

- A well-documented history of mortgage market discrimination means that blacks are significantly less likely to be homeowners than whites. This means they have less access to the savings and tax benefits of owning a home.

- Persistent labor market discrimination and segregation also force blacks into fewer and less profitable employment opportunities than their white counterparts.

Thus, Black Americans have less access to stable jobs, good wages, and retirement benefits at work— all critical drivers by which American families gain access to savings.

Moreover, higher-income families receive increased tax incentives associated with housing and retirement savings under the current tax code.

Because Black Americans tend to have lower incomes, they inevitably receive fewer tax benefits—even if they are homeowners or have retirement savings accounts.

The bottom line is that persistent housing and labor market discrimination and segregation worsen the negative cycle of wealth inequality.

Black America’s History with Black Economic Wealth & Power

Due to America’s structural racism, there is systemic inequality. It has helped create the Black-White wealth gap.

The Great Recession widened the racial wealth gap between white and Black Americans. It was already significant.

Black Power began as a revolutionary movement in the 1960s and 1970s.

It stressed racial pride, economic empowerment, and building political and cultural institutions.

In this era, there was a push to end the harm caused by the ongoing low economic status among Black Americans. It aimed to stop systemic wealth extraction and economic inequality.

It supports products and services that create wealth. It promotes alternatives to traditional practices that sustain economic inequality.

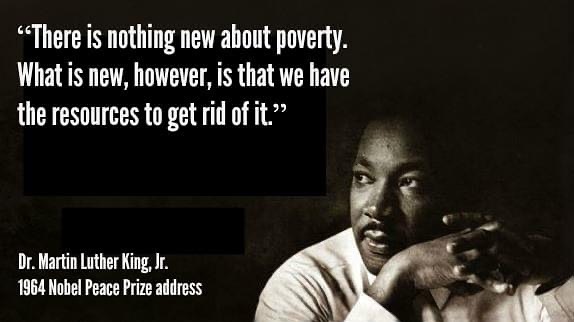

Not possible to remove the adverb. Closing racial gaps across the economy is not only about righting historical wrongs. It is also about choosing a better future. We must unlock a vast, underused talent pool for the good of all Americans.

Many Black Americans face an uphill battle in building wealth in America.

The disparities displayed during the COVID-19 pandemic amplified America’s conscience.

Job losses hit people of color harder. They lack savings to cushion the blow.

Underperforming public schools and poor digital access hurt children of color. They lost more learning as a result.

Black workers focused on low-wage, frontline jobs that required their presence. The virus and poor healthcare access widen the racial life expectancy gap.

The goal of the sobering picture is to motivate, not discourage.

Research alone could close the wage gaps in McKinsey’s report. It could move an estimated two million Black Americans into the middle class for the first time.

This could reverse current trends. It would increase the next generation’s opportunities for the middle class.

But it isn’t the best thing for the Black community.

Since Reagan won the 1980 election, the American middle class has collapsed. It has fallen from almost two-thirds to fewer than half of us.

Republicans have been warning about this since the 1950s, although not in the way you might think.

President Franklin D. Roosevelt began America’s path to the middle class. He aimed to make it the first nation, with over half its citizens in that class.

Conservative thought leaders have warned their politicians. They fear a “too large and too prosperous” middle class.

This explains why Republican actions always work against middle-class people. Worsen poverty and focus all efforts on the top 10 percent, especially the top 1 percent, of Americans.

All these Republican policies, from tax cuts to gutting unions, have a net effect. Bribing corporations will hurt the working class and reduce the middle class.

Since 1980, Republican tax cuts have shifted over $50 trillion in wealth from the middle class to the top 1%.

The Democrats are no better at closing the racial wealth gap. They only want to move Black Americans into the middle class. The Republicans are trying to cut it.

The Biden Plan to Build Back Better by Advancing Racial Equity Across the American Economy.

It contains much verbiage that supports real change. And seeks to close the racial wealth gap for black Americans.

The Congressional Republicans plan to raise inflation and costs for American families.

Neither party is making efforts to address the racial inequality within our economy. They are trying to shut Black Americans out of economic power.

A McKinsey & Company report says Black workers earn 30% less than white workers.

The report found that, due to debt, 3.5 million U.S. households have a negative net worth.

“Often, the issue with savings and wealth building is that folks don’t have enough money.” The report’s author, Shelley Stewart, will lead a McKinsey study on Black economic mobility in the U.S.

“We need to work on that as a society, often with communities of color.”

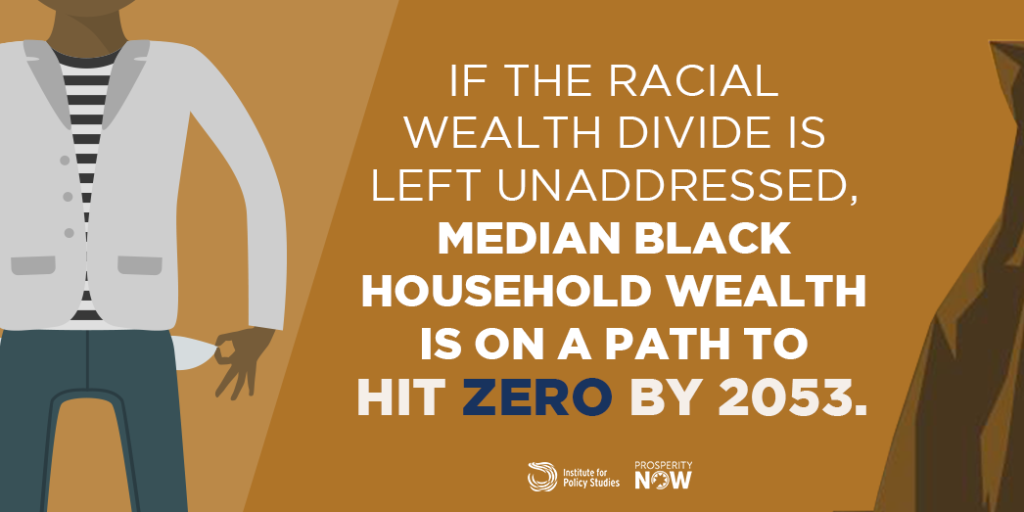

Black wealth is falling further behind.

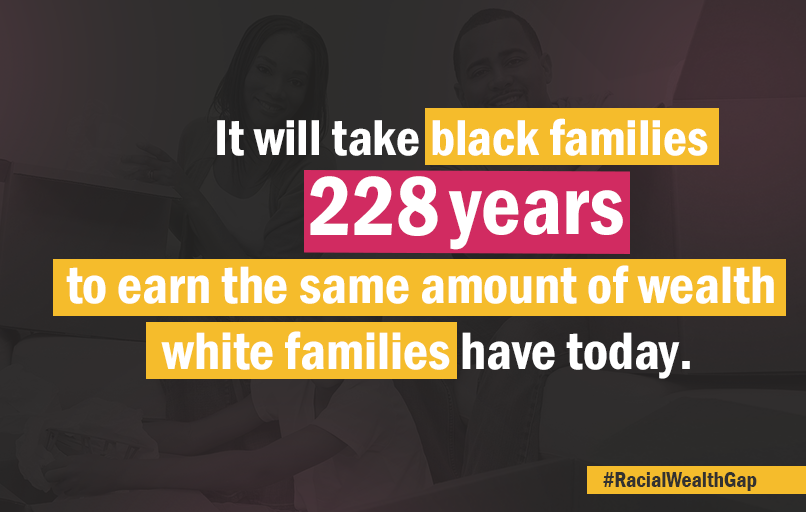

Besides, Black households start with less family wealth. McKinsey found a $330 billion gap in new wealth between Black and white families. Of that, 60% came from inheritances.

Kamila Elliott is a certified financial planner and the president of Grid 202 Partners, a D.C. financial advisory firm. She says that Black families lack wealth, so they do not invest.

The price of that gap can be huge. Elliott and Abacus Wealth CEO Brent Kessel predict that by 2064, the average white family will have $2,782,727, while the average Black family will have $789,164. That’s a 70% disparity.

Targeted policies are necessary to reverse this deepening divide.

Society needs to make changes to address the racial wealth gap. Experts say Black Americans can take steps to start building wealth now.

What are some Solutions to help Black Americans Start Building Wealth?

One solution is to change our thinking as a community. Reparations, education, housing, and investment are also essential. Support businesses, savings, and baby bonds.

Public policies alone can’t close the Black-white wealth gap without cultural change.

Reforms could lead to a considerable reduction in the net worth differential.

Policy reform should right past wrongs and ensure equal opportunity for all today.

These suggestions only scratch the surface of reforms. They show the challenge of closing the Black-white wealth gap, which a policy could help reduce.

What Can Black Americans Do to Get Started Today?

The first thing Black Americans should do is talk about it.

“Talking about money can help you make better decisions. It can also help you avoid mistakes. How do I increase this money that I have made? How do I deploy it?” Kessel added. “These discussions need to be had.”

How Do We Build Black Wealth?

According to The New England Journal of Medicine (NEJM). Recognized as the world’s leading medical journal and website.

States that Black Americans should begin by decreasing debt and increasing savings.

Managing household finances is vital to building wealth. This includes budgeting, planning, and monitoring short—and long-term savings and investments.

Black Americans must learn things not covered in school.

We are removing stigmas and providing a solid financial base for Black people.

To thrive, we must create a cooperative-focused ecosystem. It should unite families, communities, and partners. Together, we aim to build and sustain wealth for the Black diaspora. If we circulate that wealth in our community, we can close America’s racial wealth gap.

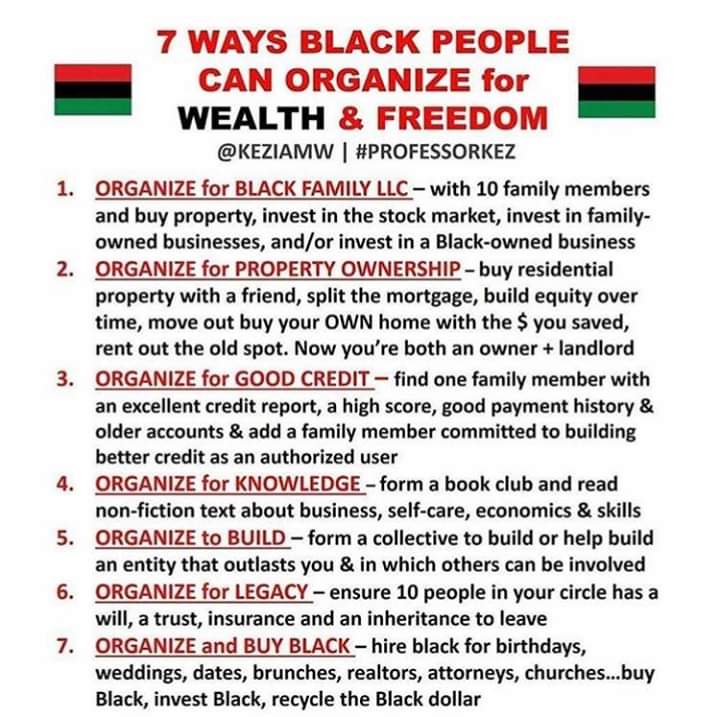

Here are seven ways for poor Americans to organize for wealth, power, and freedom.

7 Ways Black People Can Organize for Wealth & Freedom

- Organize for Black Family LLC – with 10 family members. You can trust, buy property, and invest in the stock market. Invest in family-owned businesses and invest in a Black-owned business.

- Organize for property ownership. Buy a home with a trusted, responsible friend. Split the mortgage, build equity over time, move out, buy your home with the money you saved, and rent out the old spot. Now, you’re both owners and landlords.

- Organize for Good Credit: Find a family member with excellent credit. They should have a high score, a good payment history, and old accounts. Add a responsible family member as an authorized user. They will build credit.

- Organize for Knowledge: Start a book club. Read non-fiction texts on business, self-care, economics, and skills.

- Organize to build. Form a group to create a lasting entity that others can join.

- Organize for Legacy: Ensure ten people in your circle have a will, a trust, and insurance. They should also have an inheritance to leave behind.

- Organize and Buy Black—Hire Black for events, realtors, attorneys, and churches.

Buy Black, invest black, and return the black dollar to the Black community.

In Conclusion

Building wealth and achieving financial freedom are complex journeys. They require dedication, education, and careful planning. For Black Americans, overcoming systemic barriers and historical inequities is crucial. Black Americans can build wealth by focusing on finance. They should invest in real estate, start businesses, and focus on health. This will secure a prosperous future. The latest data show progress. But, much work remains to close the racial wealth gap.

Consider signing up with Wealthy Affiliate University to support you on this journey. Wealthy Affiliate offers training, resources, and a community. They help you build your online business. Joining will give you valuable skills. They can help you achieve financial freedom. I receive a commission on all purchases made through the affiliate links in my blog and website. This helps support my work and lets me keep providing valuable content.

I also encourage you to visit my online store, jamielondonclay.com. It has products to inspire and support your self-empowerment journey. Get empowered and find inspiration in my guidance, Jamie London Clay. Please subscribe to my blog, follow me on social media, share this article with your network, and leave a comment below. Your engagement is what keeps this community thriving and growing.

Join our community. We seek to live with more freedom and authenticity. Explore more topics like this. Please consider subscribing to my YouTube channel. I’ll share more personal development and empowerment content there. I’m starting, so please be patient as I create new content. Let’s go on a journey of personal growth together. How will you begin building wealth and achieving financial freedom today?

This article offers a wealth of information and guidance on overcoming financial challenges, specifically tailored for Black Americans who face unique systemic barriers. I appreciate how it underscores the importance of community efforts and mindset shifts, alongside actionable strategies like real estate investment, credit building, and education. The historical context is also valuable, as it highlights how past injustices contribute to today’s wealth gap, making it clear that wealth-building is not only a personal goal but also a means of creating generational equity.

One question I have is about actionable first steps for those with limited resources or high debt levels. For individuals just starting their financial journey, what would be the most impactful initial moves? Should they focus more on credit repair, savings, or investing? Additionally, could you provide more examples of community-based initiatives that have successfully helped Black Americans build wealth and support one another? Thank you for this empowering and insightful piece!

Thank you so much for your thoughtful comment and insightful questions, Amalthe! I’m glad to hear that the article resonated with you and highlighted the importance of both individual and community-focused approaches to financial empowerment. Addressing the unique challenges Black Americans face is essential to creating lasting change, and I’m honored to be part of that conversation.

For individuals with limited resources or high debt levels, the most impactful initial steps often involve a balanced approach to credit repair, savings, and knowledge-building:

Credit Repair and Management: If debt is significant, focusing on credit repair is a powerful first step. Improving one’s credit score opens the door to better financial opportunities, like lower interest rates and more affordable housing options. Strategies like paying down high-interest debt first or consolidating debt with lower-interest options can make a big difference.Building an Emergency Fund: Creating a small, manageable emergency fund provides a sense of security and reduces reliance on credit in tough times. Even setting aside a little each month can build momentum and provide a foundation for future financial growth.Investing in Knowledge: If resources are limited, investing in financial literacy—through free workshops, online courses, or local community programs—can provide valuable knowledge on real estate, stock investment, and credit strategies. Knowledge is often the foundation for smart, long-term decisions.

In terms of community-based initiatives, programs like The Collective Blueprint and The Greenwood Project are doing incredible work. The Collective Blueprint supports Black entrepreneurs in building sustainable businesses, while The Greenwood Project focuses on financial literacy and investment skills for Black youth. These programs create networks of support and open pathways to financial growth.

Thank you again, Amalthe, for engaging so deeply with this topic. It’s a privilege to discuss such meaningful steps toward financial empowerment, and I’m here if you have any further questions!

Warmly,

Jamie